With ocean rates for freight shipping rising like a tsunami, don’t let high costs swamp your budget. Better to follow ICAT Logistics Detroit’s advice and find a port in the storm — a Free Trade Zone (FTZ) – that can save you money on your shipping and handling.

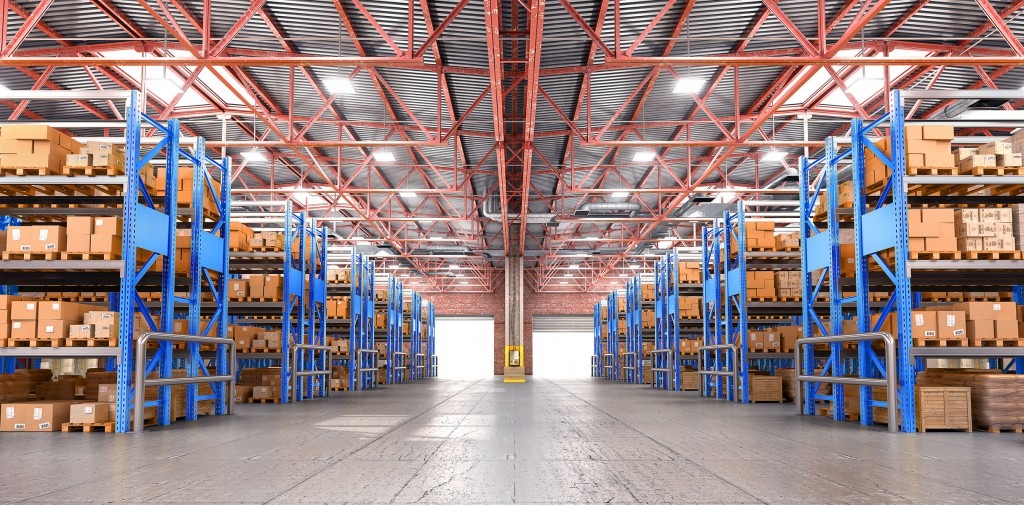

A Free Trade Zone is a duty-free area that offers warehousing, storage and distribution facilities for trade, transshipment and re-export operations. The financial advantages are significant, especially with ocean rates continuing to climb:

- Rates for an FTZ are typically low during non-peak season when customers can ship everything to the FTZ for distribution at any time.

- By utilizing the FTZ in this way, shippers avoid ocean rate increases during peak seasons, when high demand sends rates soaring.

- Storage costs at an FTZ will be relatively minimal compared to ocean shipping rate increases. An added bonus is that there’s no customs duty outlay until the merchandise enters the market.

“Global ocean rates are climbing fast with no relief in sight, with some rates at the end of 2018 expected to be triple what they were just a couple years ago,” says Chris Cser of ICAT Logistics Detroit, which has an FTZ facility in Romulus, Michigan near Detroit’s airport. “We help our customers take advantage of Free Trade Zones, which can substantially reduce their costs. We secure the shipping and warehousing so they don’t have to pay additional fees at the time of delivery.”

There are many additional advantages of using Free Trade Zones:

- Re-exports are duty exempt: Business transacted from within a FTZ is considered outside the commerce of the U.S. and U.S. Customs. As a result, if your company imports components or raw materials into a FTZ, it will not owe customs duties until it enters U.S. commerce. Materials that are exported directly from the zone pay no U.S. Customs duties.

- Duties overlooked, reduced or eliminated: Goods can enter a Free Trade Zone both duty- and fee-free. Even inventory taxes are exempt.

- Lower tariffs: Some finished products have a lower tariff assigned than components or raw materials. In a FTZ, the tariff owed is the lower of the two and since shippers of some finished goods owe no tariff whatsoever, the same would apply to components and raw materials within the FTZ.

- Improved inventory and quality control. You control the goods in an FTZ warehouse and can identify and classify them there, rather than at a Customs control facility.

- Long-term storage. Hold your goods at an FTZ warehouse as long as you wish without facing quota restrictions or paying extra higher duties.

- Transfer goods from FTZ to FTZ: Cross-dock or transfer goods from one FTZ to another within or outside of the U.S. fee-free.

Cser emphasized that ICAT Logistics is ready to guide its clients on ways to take advantage of doing business within a Free Trade Zone.

“A few basics are necessary,” Cser said. “You’ll need to track inventory, production and manufacturing orders and identify the source of the materials used – whether they are domestic or foreign. Clients must also know how to classify their goods for duty reductions and deferrals.

“ICAT can, and does, work with Free Trade Zones anywhere in the world and we operate one in Michigan, so we know how to help our customers navigate their way,” Cser said. “Those companies that take advantage of these FTZs are very happy with their results.”

We’re your custom shipping resource. Solutions to our customers’ most challenging issues are derived from decades of success in global logistics. https://www.icatlogisticsdtw.com/